What To Do If You Win The Lottery

By Zack Friedman, published on Forbes.com

If you win the next Powerball drawing, you could walk away with $650 million.

It’s easy to imagine how you might spend all that money.

Before you start spending your impending fortune, however, it’s important to ask yourself one question.

What do you actually do if you win the lottery?

Here’s what you need to know and how to execute your lottery financial game plan:

1. Sign the back of your lottery ticket

It sounds so simple, but it is the easiest step to take for granted. Despite the advent of technology, you still need to sign the back of a winning lottery ticket.

Why? Like a check, a lottery ticket is considered a bearer instrument. Whoever signs the winning lottery ticket and presents a valid photo ID can claim the lottery prize.So, sign your ticket right after you purchase it so you protect yourself in case you lose your winning ticket.

2. Choose a one-time, lump-sum payment or installment payments

You have 60 days from the day you present your winning ticket to determine how you want to receive your prize.

You have two choices when you win the lottery: you can receive a one-time, lump-sum payment or 30 installments over 29 years.

If you choose the lump-sum payment, you will receive your prize winnings upfront, and immediately will owe income tax on the full amount.

If you choose the installment plan in the form of an annuity, each installment payment will be taxed. Which should you choose? It depends in your personal preference.

Financially, a dollar today is worth more than a dollar tomorrow. If you choose the lump-sum payment, you have the peace of mind of receiving all the funds today and can invest the proceeds to earn a financial return.

However, if you prefer to set an allowance for yourself to help control spending, an annuity payment plan can help instill fiscal discipline.

You should compare the after-tax proceeds and your intended investment return (lump-sum payment) with the after-tax annuity payments and intended investment return (installment payments).

Overall, you will want to consider the time value of money — that is, how much you can earn under each scenario comparing the timing of the payments that you receive.

3. Assemble your financial and legal wolfpack

If you win the lottery, you may need help managing your new fortune. It is critical to have a team of trusted advisors to help you manage an array of investment, accounting, tax and legal issues.Expect to be approached by just about every type of advisor who wants to lend a helping hand.

Invest the time to make careful selections about who you want in your inner circle.

Not all advisors are created equally, so you will want to vet personally each new advisor you retain.

Don’t outsource this function. It’s your money, and you need to protect it.

You should interview each prospective candidate, and make sure he or she understands your goals.

Make sure to check their credentials to ensure they are properly licensed.

Advice is not always free so make sure to understand their fee arrangements before you retain them.

Most importantly, hire a team that tells you “no.”

The last thing you want is a team that says “yes” to every time you want to spend money on large purposes.

It’s your call how you spend your money, but it’s helpful to have a team that gives you honest advice even if it’s not what you want to hear.

4. Don’t abandon your budget

Wait, you just won hundreds of million of dollars. Why would you still need a budget?

Financial discipline doesn’t go away when you become a millionaire.

You may have more money, but that doesn’t mean the same principles of personal finance do not apply.

With more financial resources, there may be more things to purchase.

That’s why budgeting is even more essential.

Develop an action plan that accounts for your monthly and annual spending. Categorize your major expenses. Understand your income sources.

One strategy to instill financial discipline is to live off your income, not your prize winnings.

Therefore, you can preserve principal.

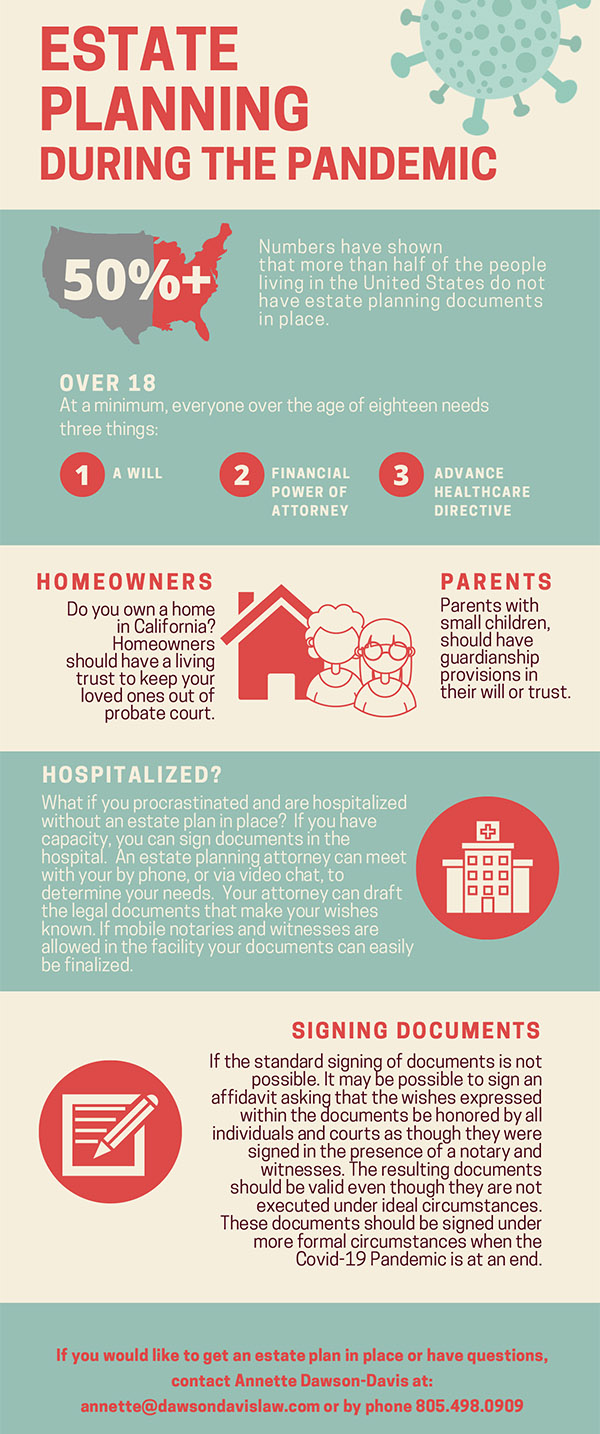

5. Take care of your heirs with an estate plan

If you have an existing estate plan, now is the time to update it.

If you have never put one together, now is the time to create one.

When you win the lottery, or have any major life change, it’s essential to ensure that your estate plan reflects your new reality.

With an estate plan, you will want to protect your estate, institute tax planning and consider how to provide for your heirs.