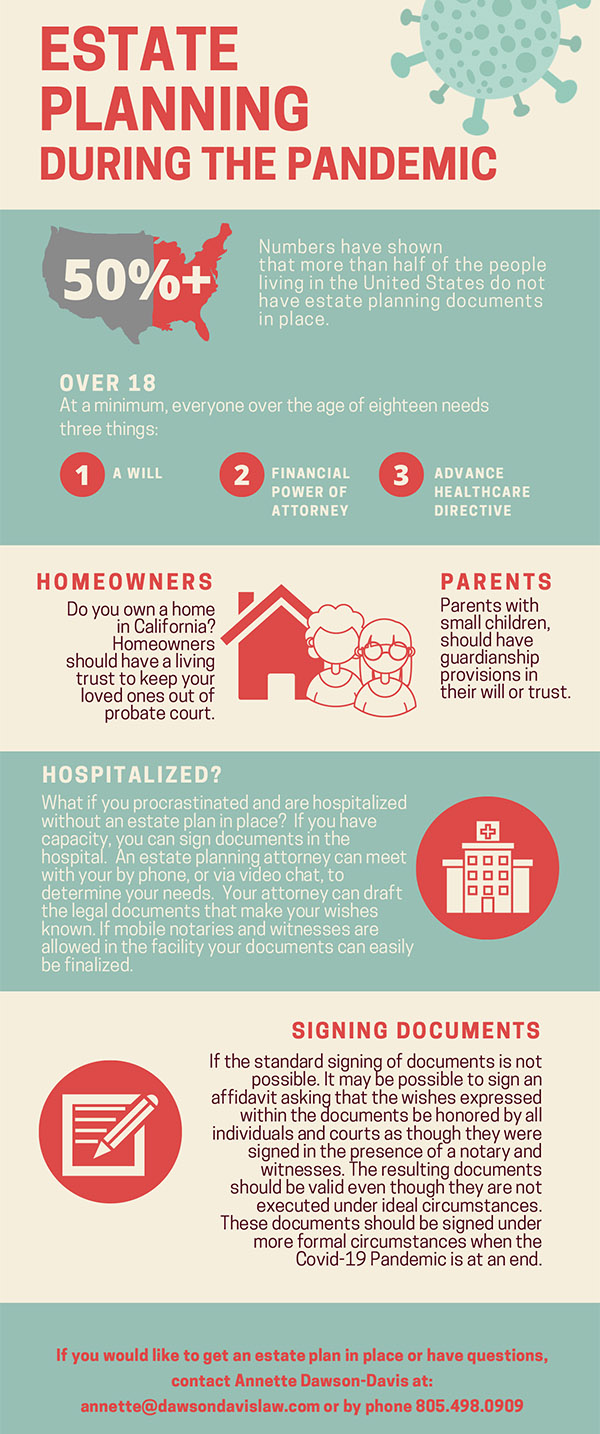

Numbers have shown that more than half of the people living in the United States do not have estate planning documents in place. It seems during this Covid-19 pandemic, that many people who have procrastinated for years suddenly feel an urgent need to complete their estate plan. At a minimum, everyone over the age of eighteen needs three things: a will, a financial power of attorney and an advance health care directive. Parents with small children, should have guardianship provisions in their will or trust. Homeowners in California should have a living trust to keep loved ones out of probate court.

What if you procrastinated and you are in the hospital with no estate planning in place? If you have capacity, you can sign documents in the hospital. An estate planning attorney can talk to you over the phone, or via video chat, to determine your needs. Your attorney can draft the legal documents that make your wishes known. If mobile notaries and witnesses are allowed in the facility your documents can easily be finalized.

If it is not possible to execute estate planning documents using the standard practice of signing a will before two independent witnesses and notarizing all the other documents. It may be possible to sign an affidavit asking that the wishes expressed within the documents be honored by all individuals and courts as though they were signed in the presence of a notary and witnesses. The result is that the documents should be valid even though they are not executed under ideal circumstances. These documents should be signed under more formal circumstances when the Covid-19 Pandemic is at an end.